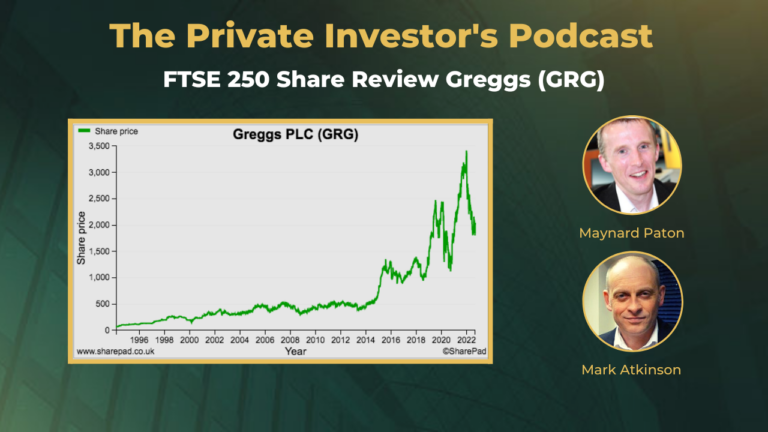

PIP004 FTSE 250 Share Review Greggs (GRG)

Hosted by Maynard Paton and Mark Atkinson

PIP004 FTSE 250 Share Review Greggs (GRG)

Share:

Welcome to The Private Investor’s Podcast. This time Maynard and Mark’s share review of FTSE of 250 listed Greggs (GRG) and the investment potential of sausage rolls.

Mark first bought Greggs in 2003 before selling it in 2005. Mark began buying again in 2017 at £10.24 adding several times with the latest purchase at £18.00

Greggs is now one of Mark’s top five holdings accounting for 5% of his overall portfolio.

The question is; what does the future hold for Greggs? Will Maynard be buying, does Mark hold, buy more, or sell?

Main Topics Covered:

- Mark – buying – 5% holding

- Business overview of Greggs,

- General bull case – case against the rough economy, higher business costs (energy) etc?

- Greggs superfans/clothing/tattoos

- Financial history

- Impressive track record, cash/special/freeholds.

- Productivity improvements, revenue per employee/store

- Family management/Ian Gregg

- Recent management/new CEO

- The 5-year plan — outline, upsides

- The 5-year plan — costs, downsides

- Director PSPs

- H1 results

- H1 results (small print)

- Valuation

- Mark/Maynard – Buy/Hold/Sell

Hope you enjoy it and have a wonderful day.

Maynard & Mark.

If you like the episode, please subscribe for future company reviews.

Disclaimer: This presentation is for educational purposes only. All opinions and information are for demonstrational purposes and do not constitute investment advice. Trading and investing carries a high level of risk and are not right for everyone. If you need financial advice, consult with a regulated financial adviser in your country before making any decisions.