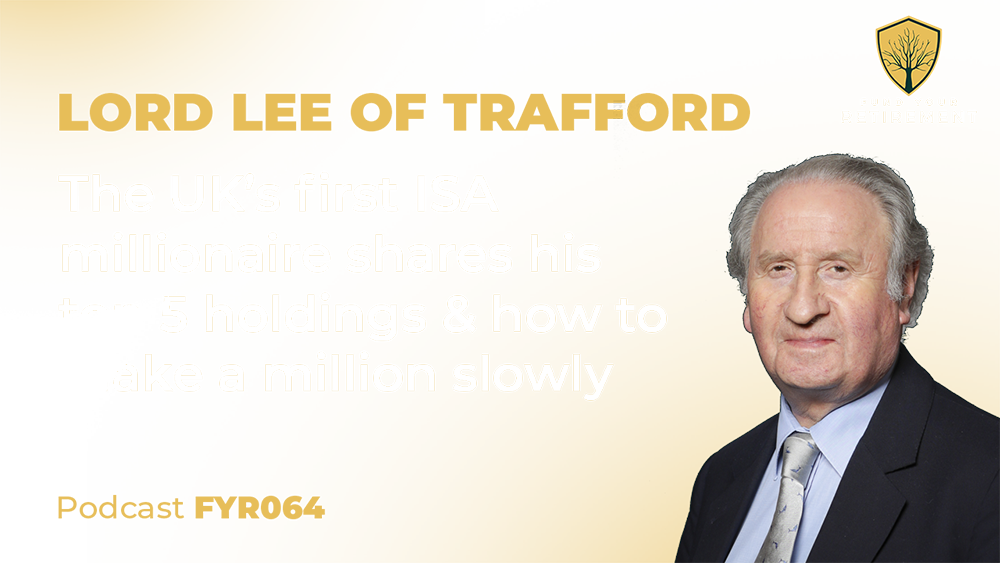

FYR064 Lord Lee of Trafford: How To Make a Million Slowly

Lord Lee of Trafford holds the accolade of becoming the first ISA millionaire in 2003. Lord Lee is a well-known and respected private investor who has been investing in the UK small-caps very successfully for many decades. During this interview; Lord John Lee reflects on his many years of investing and discusses the types of businesses he invests in, why he likes AGMs, how he assesses management, his top five holdings and the recent 30% drop in one of his largest holdings, Treatt