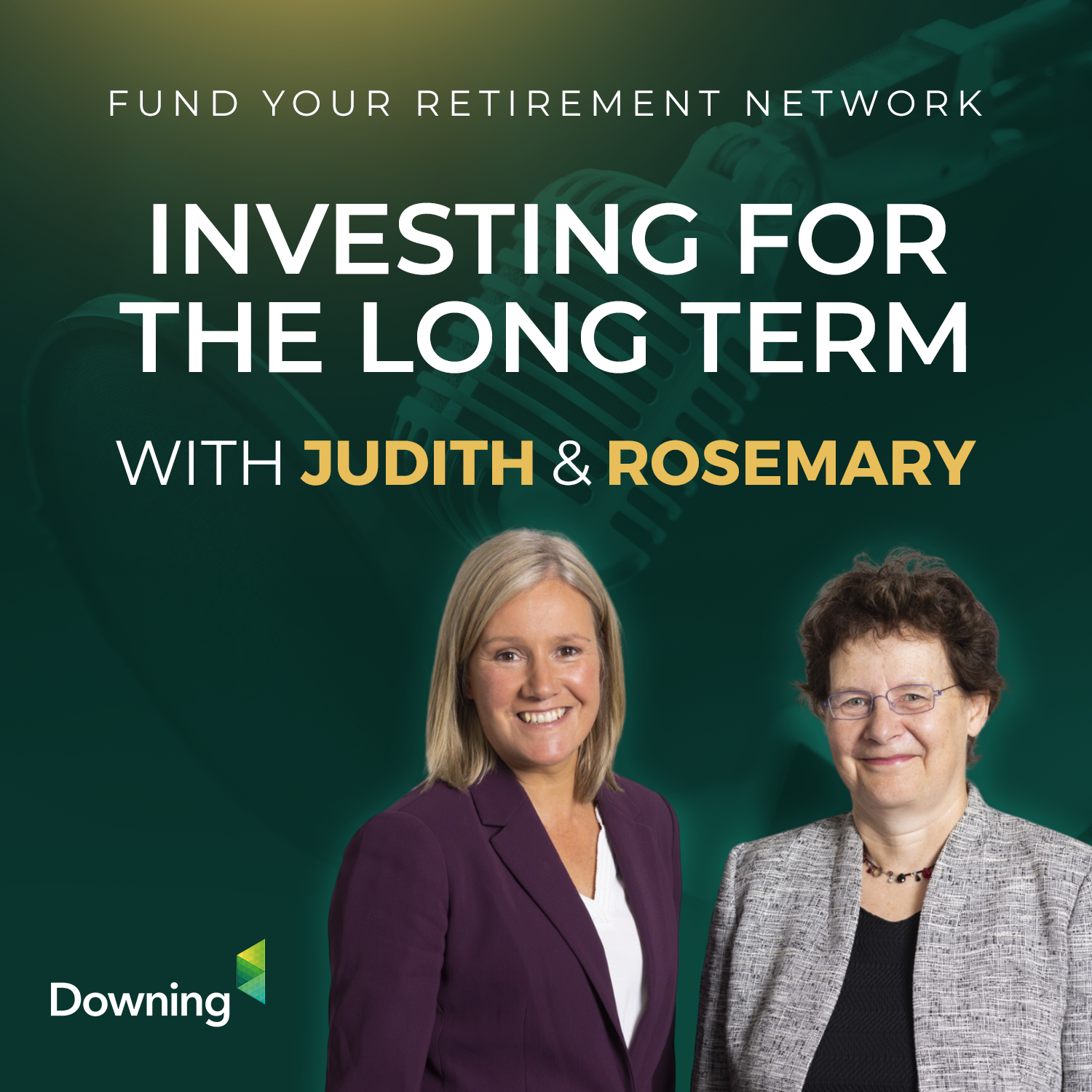

ILT015 Quoted Companies Alliance (QCA) CEO James Ashton on Journalism, Economics & the Markets (S2 EP07)

In the latest episode of ‘Investing for the Long Term,’ hosts Judith McKenzie and Rosemary Banyard welcome James Ashton, Chief Executive of the Quoted Companies Alliance (QCA). James reflects on his diverse and illustrious career, from his early days as a financial journalist to his current role as CEO at the Quoted Companies Alliance (QCA).