VTP004 UK Small-Caps, Artificial Intelligence Mania, Using Stop Losses & Investor Red Flags

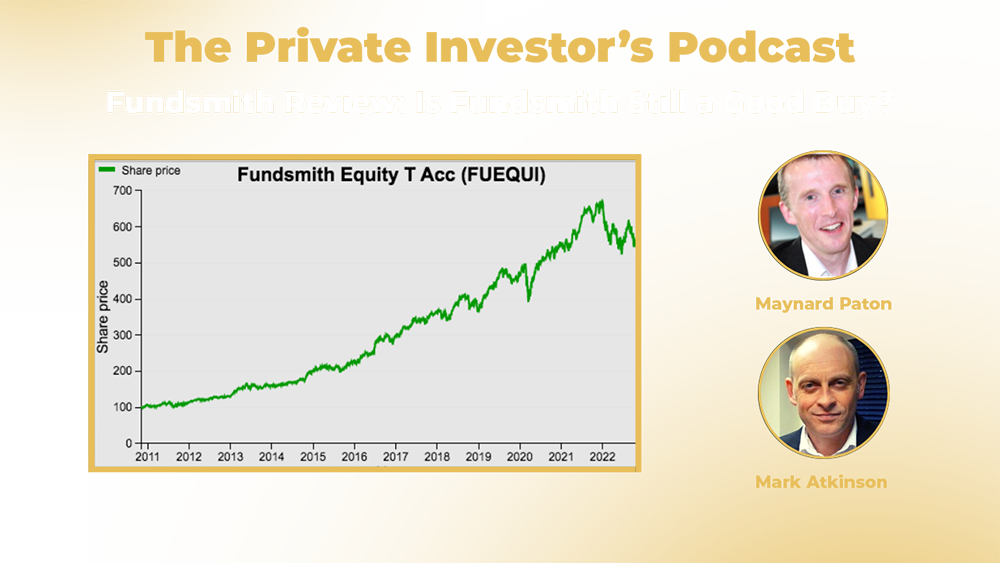

Bruce Packard and Mark Simpson discuss artificial intelligence, UK small-caps DX Group (DX), Bruce’s recent purchases of Frontier Developments (FDEV) and the most recent addition to Mark’s portfolio Paypoint (PAY). Other key topics were, how to potentially play the artificial intelligence mania, attending Mello and listening to Lord Lee present. When is the right time to use stop losses, broker forecasts and investor red flags to watch out for?